FACT CHECK: Did ‘Hardly Anyone’ Pay 90 Percent In Taxes Under Eisenhower?

Many people on Twitter claimed recently that few people paid 90 percent in taxes under Republican President Dwight D. Eisenhower in the 1950s.

Outside of Pearl Harbor America didn’t need to be rebuild after WWII but America did use $120 billion inflation-adjusted dollars to rebuild Europe. WWII ushered in job growth, women in the workforce and ended the Great Depression. Hardly anyone paid 90% https://t.co/CyN8RQNnC5 https://t.co/9shlCu571s

— Charles V Payne (@cvpayne) January 6, 2019

“Hardly anyone paid 90%,” Fox Business host Charles Payne said Sunday.

Many other laypeople made the claim.

Stop giving vaguely dismissive opinions. Virtually no one paid a 90% tax rate. It’s absolutely preposterous to suggest they did, much less that a society could sustain without mass starvation in such an economically illiterate system. pic.twitter.com/duvSrrslaW

— Lou Salvati IV (@LibertyLou4) January 5, 2019

“Virtually no one paid a 90% tax rate,” one user said Saturday.

*sigh*…since you wont read the thread…I will explain again, for the 41st time.

Almost nobody actually paid the marginal 90% rate, there were major deductions such as real estate depreciation/loan expenses/ Did not include CGs. The effective tax rate for top earners was 45%.

— Logical Liberty (@LogicaLiberty) January 4, 2019

“Almost nobody actually paid the marginal 90% rate, there were major deductions such as real estate depreciation/loan expenses/ Did not include CGs,” another tweet said Friday.

Verdict: True

While the top marginal income tax rate was over 90 percent while Eisenhower was president, few people were subject to that rate due to deductions and other tax loopholes. Top income earners paid much lower average tax rates.

Fact Check:

Freshman Democratic Rep. Alexandria Ocasio-Cortez suggested on “60 Minutes” Sunday that a 60 or 70 percent top marginal tax rate could help pay for the “Green New Deal,” a broad plan that includes moving the U.S. to 100 percent green energy in 10 years and universal health care programs. She mentioned that there were similarly high income tax rates in the 1960s.

70% tax rates on the very rich would help pay for the #GreenNewDeal to combat climate change, @AOC told Anderson Cooper: “Only radicals have changed this country.” https://t.co/MWDhzh4hTr pic.twitter.com/NTuaJ38cbC

— 60 Minutes (@60Minutes) January 7, 2019

“You look at our tax rates back in the ’60s, and when you have a progressive tax rate system … Once you get to, like, the tippy tops – on your 10 millionth dollar – sometimes you see tax rates as high as 60 or 70 percent,” Ocasio-Cortez said.

Liberal commentators and journalists noted that marginal tax rates topped 90 percent under Eisenhower in response to Ocasio-Cortez’s comments.

Under #Eisenhower the top marginal tax rate (which is what @AOC is talking about) was 90 per cent. To be sure, Ike was nothin’ but a damn RINO. But still. https://t.co/COahN9b8xp

— Hendrik Hertzberg (@RickHertzberg) January 6, 2019

“Under #Eisenhower the top marginal tax rate (which is what @AOC is talking about) was 90 per cent,” New Yorker senior editor and staff writer Hendrik Hertzberg tweeted Saturday.

It’s true that the top marginal individual income tax rate under Eisenhower was very high – 91 percent during the bulk of his tenure, which lasted from 1953 to 1961.

However, conservative commentators correctly note that hardly anyone paid that much.

In 1958, only around 10,000 out of 45.6 million tax filers had incomes that put them in the 81 percent bracket or higher, according to The Wall Street Journal. That amounts to about 0.02 percent of filers subject to the 81 percent rate, let alone the 91 percent rate.

Additionally, top income earners paid much lower average rates under Eisenhower.

The U.S. uses a marginal income tax system, meaning not all income is taxed at the same rate, and those who reach higher brackets still pay the lower tax bracket rate on some of their income.

For example, in 2018, a married couple filing jointly that makes $100,000 is subject to a 10 percent tax on the first $19,050, 12 percent on the next $58,350 and 22 percent on the remaining $22,600.

In 1955, any income that married couples filing jointly earned up to $4,000 was taxed at 20 percent, while the 91 percent rate kicked in for each dollar earned over $400,000 – the equivalent of $3,426,776 in constant 2013 dollars, according to the right-leaning Tax Foundation.

Actual tax paid as a percentage of income is called an effective or average tax rate.

The top 1 percent of income earners paid an average effective income tax rate of 16.9 percent in the 1950s, according to data compiled by the Tax Foundation from a 2017 paper by economics professors. That figure includes all federal, state and local income taxes.

When including additional federal and local taxes, such as payroll, property and estate taxes, the Tax Foundation reported that the top 1 percent of income earners had a 42 percent average effective tax rate in the 1950s. In 2014, that number was lower – 36.4 percent.

The Tax Foundation’s calculations are consistent with findings from two of the paper’s authors, Professors Thomas Piketty of the Paris School of Economics and Emmanuel Saez of the University of California- Berkeley, in a different paper from 2007. In 1960, those making more than 99.5 percent to 99.9 percent of the population paid an average federal tax rate of 41.4 percent, the paper said.

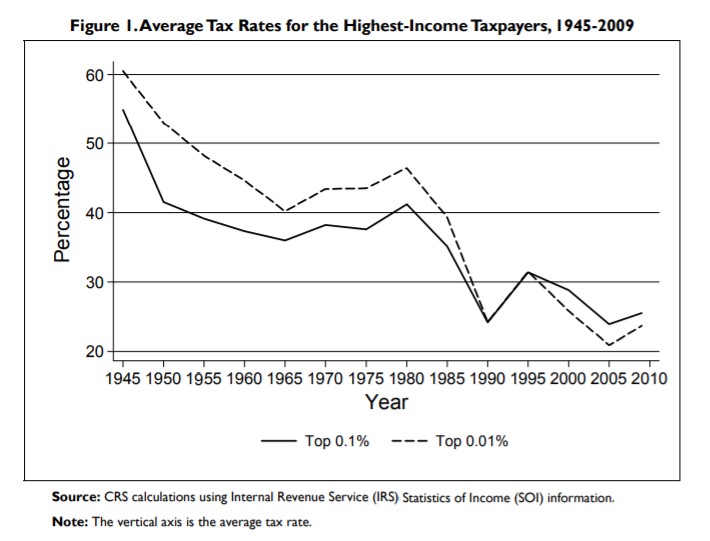

Congressional Research Service calculations of data from the Internal Revenue Service similarly found in a 2012 report that the very top income earners – the top 0.1 percent and 0.01 percent – also paid effective tax rates lower than the 91 percent top marginal tax rate in the 1950s. The average rate for the top 0.1 percent fell from the low 40 percent range to the high 30 percent range during the 1950s. For the top 0.01 percent, it fell from the 50 percent range to the mid-40 percent range.

Screenshot: Congressional Research Service report, “Taxes and the Economy: An Economic

Analysis of the Top Tax Rates Since 1945″

Tax loopholes contributed to the rich paying lower effective income tax rates.

Piketty and Saez wrote in their 2007 paper that while the overall tax system was more progressive at the top of the income scale in 1960 than in 2004 – the top 0.01 percent paid an average total federal tax rate of 71.4 percent in 1960 compared to 34.7 percent in 2004 – that was not primarily due to extremely high income tax rates.

A number of tax deductions, along with lower rates on realized capital gains, “reduced dramatically what otherwise looked like an extremely progressive” income tax schedule in 1960, when the top individual tax rate was 91 percent, the paper said. “In the 1960s, top incomes were primarily composed of capital income: mostly dividends and capital gains.”

The authors attributed the progressive nature of the tax system in 1960 to the corporate income and estate taxes.

The free-market Mises Institute demonstrated the complexity of the tax system by comparing income tax receipts as a percentage of gross domestic product (GDP) to the top marginal tax rate. Data from the White House’s Office of Management and Budget show that federal income tax receipts as a percentage of GDP have fluctuated between 5.6 percent and 9.9 percent since 1950, despite dramatic changes in the top marginal income tax rate.

It is “critical to take into account other taxes than the individual income tax to assess properly the extent of overall tax progressivity,” Piketty and Saez wrote.

Have a fact check suggestion? Send ideas to [email protected]

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].